Withholding Tax Setup In Oracle Apps

Contents

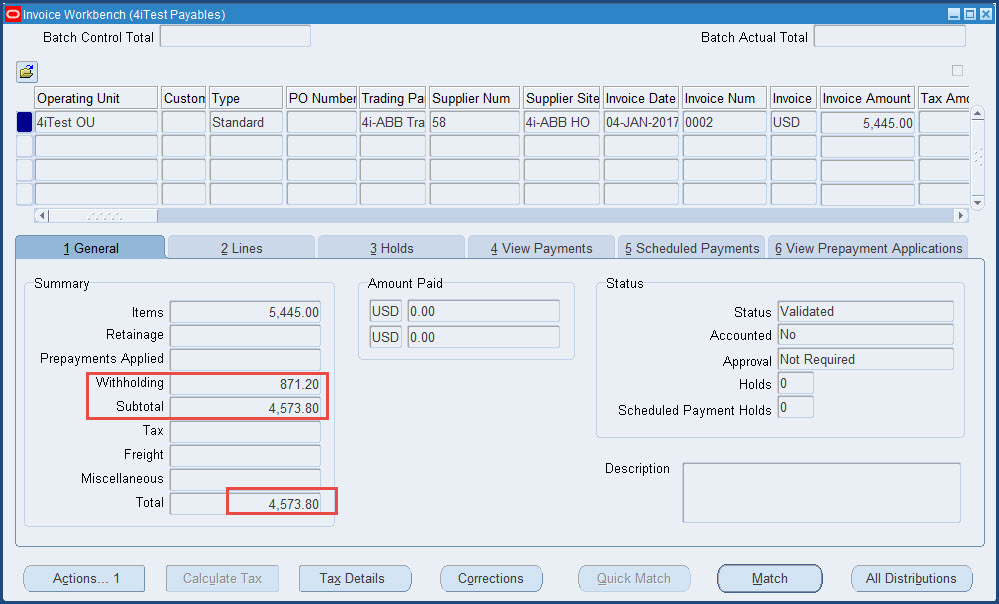

Iv Oracle Payables User Guide Setting up Your Accounting Method 2 – 56. Payables Options 2 – 58. Aug 20, 2015 Payables can automatically create withholding tax invoices, or you can perform this task manually. If you choose to automatically create withholding tax invoices, you must choose whether to do this during Approval or during payment processing. Indicate this choice in the Withholding Tax region of the Payables Options window.

-- EBTAX SETUP TABLES --

Following are themain E-Business tax tables that will contain the setup informationthat will help support in troubleshooting E-Business tax information.

a. Tax Regimes:ZX_REGIMES_B

b. Taxes:ZX_TAXES_B

c. Tax Status:ZX_STATUS_B

d. Tax Rates:ZX_RATES_B

e. TaxJurisdictions: ZX_JURISDICTIONS_B

f. Tax Rules:ZX_RULES_B

To get a dump ofthe eTax setups, you can use the following set of queries.

Please provide thetax regime code when prompted. If the issue is limited to a tax then providethe tax name when prompted else please leave it blank.

SELECT *

FROM zx_regimes_b

WHEREtax_regime_code = '&tax_regime_code';

SELECT *

FROM zx_taxes_b

WHEREDECODE('&tax_name',null,'xxx',tax) = nvl('&tax_name','xxx')

AND tax_regime_code= '&tax_regime_code';

SELECT *

FROM zx_status_b

WHERE tax ='&tax_name'

AND tax_regime_code= '&tax_regime_code';

SELECT *

FROM zx_rates_b

WHERE tax ='&tax_name'

AND tax_regime_code= '&tax_regime_code';

SELECT *

FROMzx_jurisdictions_b

WHERE DECODE('&tax_name',null,'xxx',tax)= nvl('&tax_name','xxx')

AND tax_regime_code= '&tax_regime_code';

SELECT *

Hot Soup Processor (aka 'HSP') is a programming tool for Windows, developed by Onitama (ONION software) in Japan.It allows you to create a game, application, and so on. Now HSP is released version 3.x. Completely free; interpreted language (no machine-code). Hot Soup Processor Games Games Use immediately, refrigerate for up to 5 days, or freeze for up to 2 months. Or omit the sage, season with ground cinnamon and freshly. Hot Soup Processor Gamehouse. Check out the word games on Addicting Games.Our library is full of new releases and all-time classic online word games. Hot soup processor game.

FROM zx_rules_b

WHERE tax ='&tax_name'

AND tax_regime_code= '&tax_regime_code';

-- EBTAX TRANSACTION TABLES --

Following are themain E-Business tax tables that will contain the transactioninformation that will have the tax details after tax is calculated.

a. ZX_LINES: Thistable will have the tax lines for associated with PO/Release schedules.

TRX_ID: TransactionID. This is linked to the

PO_HEADERS_ALL.PO_HEADER_ID

TRX_LINE_ID:Transaction Line ID. This is linked to the

PO_LINE_LOCATIONS_ALL.LINE_LOCATION_ID

b.ZX_REC_NREC_DIST: This table will have the tax distributions for associatedwith PO/Release distributions.

TRX_ID: TransactionID. This is linked to the

PO_HEADERS_ALL.PO_HEADER_ID

TRX_LINE_ID:Transaction Line ID. This is linked to the

PO_LINE_LOCATIONS_ALL.LINE_LOCATION_ID

TRX_LINE_DIST_ID:Transaction Line Distribution ID. This is linked to the

PO_DISTRIBUTIONS_ALL.PO_DISTRIBUTION_ID

RECOVERABLE_FLAG:Recoverable Flag. If the distribution is recoverable then the flag will be setto Y and there will be values in the RECOVERY_TYPE_CODE and RECOVERY_RATE_CODE.

c.PO_REQ_DISTRIBUTIONS_ALL: This table will have the tax distributions forassociated with Requisition distribution.

RECOVERABLE_TAX:Recoverable tax amount

NONRECOVERABLE_TAX:Non Recoverable tax amount

d.ZX_LINES_DET_FACTORS: This table holds all the information of the tax linetransaction for both the requisitions as well as the purchase orders/releases.

TRX_ID: TransactionID. This is linked to the

PO_REQUISITION_HEADERS_ALL.REQUISITION_HEADER_ID/

PO_HEADERS_ALL.PO_HEADER_ID

TRX_LINE_ID:Transaction Line ID. This is linked to the

PO_REQUISITION_LINES_ALL.REQUISITION_LINE_ID/

PO_LINE_LOCATIONS_ALL.LINE_LOCATION_ID

-- SQL FOR PARTY FISCAL CLASSIFICATION CODE --

SELECT HPP.PARTY_NAME,HP.PARTY_SITE_NAME ,HCA.*FROM ZX_PARTY_TAX_PROFILE ZP

,HZ_CODE_ASSIGNMENTS HCA

,HZ_PARTY_SITES HP

,HZ_PARTIES HPP

WHERE ZP.PARTY_TAX_PROFILE_ID = HCA.OWNER_TABLE_ID

--AND ZP.PARTY_ID = :PARTY_ID

AND HCA.OWNER_TABLE_NAME = 'ZX_PARTY_TAX_PROFILE'

AND HP.PARTY_SITE_ID = ZP.PARTY_ID

AND HPP.PARTY_ID= HP.PARTY_ID

AND HCA.CLASS_CODE IS NOT NULL

ORDER BY ZP.LAST_UPDATE_DATE DESC

SELECT HP.PARTY_ID, HP.PARTY_NAME, HPS.PARTY_SITE_ID, HPS.PARTY_SITE_NAME, ZP.PARTY_TAX_PROFILE_ID

FROM ZX_PARTY_TAX_PROFILE ZP,

HZ_PARTY_SITES HPS,

HZ_PARTIES HP,

HZ_CUST_ACCOUNTS_ALL CA

WHERE HP.PARTY_ID = HPS.PARTY_ID

AND HP.PARTY_ID = CA.PARTY_ID

AND HPS.PARTY_SITE_ID = ZP.PARTY_ID

AND CA.CUSTOMER_CLASS_CODE = 'WEB CUSTOMER'

AND UPPER(HP.PARTY_NAME) LIKE 'CAROLE%FINCK%'

AND EXISTS (

SELECT 1

FROM HZ_CODE_ASSIGNMENTS HCA

WHERE HCA.OWNER_TABLE_ID = ZP.PARTY_TAX_PROFILE_ID

AND HCA.OWNER_TABLE_NAME = 'ZX_PARTY_TAX_PROFILE'

AND HCA.CLASS_CODE IS NOT NULL)

ORDER BY ZP.LAST_UPDATE_DATE DESC;

-- BELOW QUERY RETRIEVES CUSTOMER ADDRESSES THAT DOESNT HAVE ANY GEOGRAPHY REFERENCE --

SELECT HCA.ACCOUNT_NUMBER,HCA.ACCOUNT_NAME

,HCS_SHIP.SITE_USE_CODE

,HL_SHIP.ADDRESS1 ADDRESS

,HL_SHIP.STATE STATE

,HL_SHIP.COUNTY COUNTY

,HL_SHIP.CITY CITY

,HL_SHIP.POSTAL_CODE

FROM HZ_CUST_SITE_USES_ALL HCS_SHIP

, HZ_CUST_ACCT_SITES_ALL HCA_SHIP

, HZ_CUST_ACCOUNTS HCA

, HZ_PARTY_SITES HPS_SHIP

, HZ_LOCATIONS HL_SHIP

WHERE HCA.CUST_ACCOUNT_ID=HCA_SHIP.CUST_ACCOUNT_ID(+)

AND HCS_SHIP.CUST_ACCT_SITE_ID(+) = HCA_SHIP.CUST_ACCT_SITE_ID

-- AND HCA.ACCOUNT_NUMBER='10001'

AND HCA_SHIP.PARTY_SITE_ID = HPS_SHIP.PARTY_SITE_ID

AND HPS_SHIP.LOCATION_ID = HL_SHIP.LOCATION_ID

AND HCA.STATUS='A'

AND HCS_SHIP.STATUS='A'

AND HCA_SHIP.STATUS='A'

AND HL_SHIP.COUNTRY='US'

AND NOT EXISTS (SELECT 1 FROM HZ_GEOGRAPHIES HG

WHERE HG.GEOGRAPHY_ELEMENT2_CODE=HL_SHIP.STATE

AND UPPER(HL_SHIP.COUNTY)=UPPER(HG.GEOGRAPHY_ELEMENT3_CODE)

AND UPPER(HL_SHIP.CITY)=UPPER(HG.GEOGRAPHY_ELEMENT4_CODE)

AND SYSDATE BETWEEN HG.START_DATE AND HG.END_DATE)

-- BELOW SQL QUERY RETRIEVES LIST OF JURISDICTIONS' FOR WHICH TAX RATES HAS BEEN DEFINED --

SELECT TAX,TAX_JURISDICTION_CODE,

GEOGRAPHY_ELEMENT2_CODE STATE_CODE,

GEOGRAPHY_ELEMENT3_CODE COUNTY_CODE,

GEOGRAPHY_ELEMENT4_CODE CITY_CODE

FROM ZX_JURISDICTIONS_B ZJ,

HZ_GEOGRAPHIES HG

WHERE

ZJ.TAX_REGIME_CODE='US_SALE_AND_USE_TAX'

AND SYSDATE BETWEEN ZJ.EFFECTIVE_FROM AND NVL(ZJ.EFFECTIVE_TO,'31-DEC-4999')

AND SYSDATE BETWEEN HG.START_DATE AND HG.END_DATE

AND ZJ.ZONE_GEOGRAPHY_ID=HG.GEOGRAPHY_ID

AND ZJ.TAX=HG.GEOGRAPHY_TYPE

AND NOT EXISTS (SELECT 1 FROM ZX_RATES_B ZR

WHERE

ZR.TAX_REGIME_CODE='US_SALE_AND_USE_TAX'

AND ZR.TAX_JURISDICTION_CODE=ZJ.TAX_JURISDICTION_CODE)

ORDER BY TAX,

TAX_JURISDICTION_CODE,

GEOGRAPHY_ELEMENT2_CODE ,

GEOGRAPHY_ELEMENT3_CODE,

GEOGRAPHY_ELEMENT4_CODE

-- BELOW QUERY RETRIEVES LIST OF GEOGRAPHY'S WITHOUT JURISDICTIONS--

SELECT * FROM(SELECT GEOGRAPHY_TYPE,

GEOGRAPHY_ELEMENT2_CODE STATE_CODE,

GEOGRAPHY_ELEMENT3_CODE COUNTY_CODE,

GEOGRAPHY_ELEMENT4_CODE CITY_CODE

FROM

HZ_GEOGRAPHIES HG

WHERE HG.GEOGRAPHY_TYPE='STATE'

AND SYSDATE BETWEEN HG.START_DATE AND HG.END_DATE

AND GEOGRAPHY_ELEMENT1_CODE='US'

AND NOT EXISTS (SELECT 1 FROM ZX_JURISDICTIONS_B ZJ

WHERE ZJ.ZONE_GEOGRAPHY_ID=HG.GEOGRAPHY_ID

AND ZJ.TAX_REGIME_CODE='US_SALE_AND_USE_TAX'

AND SYSDATE BETWEEN ZJ.EFFECTIVE_FROM AND NVL(ZJ.EFFECTIVE_TO,'31-DEC-4999')

AND ZJ.TAX=HG.GEOGRAPHY_TYPE)

UNION

SELECT GEOGRAPHY_TYPE,

GEOGRAPHY_ELEMENT2_CODE STATE_CODE,

GEOGRAPHY_ELEMENT3_CODE COUNTY_CODE,

GEOGRAPHY_ELEMENT4_CODE CITY_CODE

FROM

HZ_GEOGRAPHIES HG

WHERE HG.GEOGRAPHY_TYPE='COUNTY'

AND SYSDATE BETWEEN HG.START_DATE AND HG.END_DATE

AND GEOGRAPHY_ELEMENT1_CODE='US'

AND NOT EXISTS (SELECT 1 FROM ZX_JURISDICTIONS_B ZJ

WHERE ZJ.ZONE_GEOGRAPHY_ID=HG.GEOGRAPHY_ID

AND ZJ.TAX_REGIME_CODE='US_SALE_AND_USE_TAX'

AND SYSDATE BETWEEN ZJ.EFFECTIVE_FROM AND NVL(ZJ.EFFECTIVE_TO,'31-DEC-4999')

AND ZJ.TAX=HG.GEOGRAPHY_TYPE)

UNION

SELECT GEOGRAPHY_TYPE,

GEOGRAPHY_ELEMENT2_CODE STATE_CODE,

GEOGRAPHY_ELEMENT3_CODE COUNTY_CODE,

GEOGRAPHY_ELEMENT4_CODE CITY_CODE

FROM

HZ_GEOGRAPHIES HG

WHERE HG.GEOGRAPHY_TYPE='CITY'

AND SYSDATE BETWEEN HG.START_DATE AND HG.END_DATE

AND GEOGRAPHY_ELEMENT1_CODE='US'

AND NOT EXISTS (SELECT 1 FROM ZX_JURISDICTIONS_B ZJ

WHERE ZJ.ZONE_GEOGRAPHY_ID=HG.GEOGRAPHY_ID

AND ZJ.TAX_REGIME_CODE='_US_SALE_AND_USE_TAX'

AND SYSDATE BETWEEN ZJ.EFFECTIVE_FROM AND NVL(ZJ.EFFECTIVE_TO,'31-DEC-4999')

AND ZJ.TAX=HG.GEOGRAPHY_TYPE))

ORDER BY GEOGRAPHY_TYPE,STATE_CODE,

COUNTY_CODE,

CITY_CODE

--SUPPLIER TAX REGISTRATION CREATION--

Use the below script to create Tax Registrations for suppliers - if you have defined any tax rule based on Tax RegistrationsDECLARE X_RETURN_STATUS VARCHAR2(1);

BEGIN

ZX_REGISTRATIONS_PKG.INSERT_ROW ( P_REQUEST_ID => NULL

,P_ATTRIBUTE1 => NULL

,P_ATTRIBUTE2 => NULL

,P_ATTRIBUTE3 => NULL

,P_ATTRIBUTE4 => NULL

,P_ATTRIBUTE5 => NULL

,P_ATTRIBUTE6 => NULL

,P_VALIDATION_RULE => NULL

,P_ROUNDING_RULE_CODE => 'UP'

,P_TAX_JURISDICTION_CODE => NULL

,P_SELF_ASSESS_FLAG => 'Y'

,P_REGISTRATION_STATUS_CODE => 'REGISTERED'

,P_REGISTRATION_SOURCE_CODE => 'IMPLICIT'

,P_REGISTRATION_REASON_CODE => NULL

,P_TAX => NULL

,P_TAX_REGIME_CODE => 'DAR'

,P_INCLUSIVE_TAX_FLAG => 'N'

,P_EFFECTIVE_FROM => TO_DATE('01-DEC-2007','DD-MON-YYYY')

,P_EFFECTIVE_TO => NULL

,P_REP_PARTY_TAX_NAME => NULL

,P_DEFAULT_REGISTRATION_FLAG => 'N'

,P_BANK_ACCOUNT_NUM => NULL

,P_RECORD_TYPE_CODE => NULL

,P_LEGAL_LOCATION_ID => NULL

,P_TAX_AUTHORITY_ID => NULL

,P_REP_TAX_AUTHORITY_ID => NULL

,P_COLL_TAX_AUTHORITY_ID => NULL

,P_REGISTRATION_TYPE_CODE => NULL

,P_REGISTRATION_NUMBER => NULL

,P_PARTY_TAX_PROFILE_ID => 812988

,P_LEGAL_REGISTRATION_ID => NULL

,P_BANK_ID => NULL

,P_BANK_BRANCH_ID => NULL

,P_ACCOUNT_SITE_ID => NULL

,P_ATTRIBUTE14 => NULL

,P_ATTRIBUTE15 => NULL

,P_ATTRIBUTE_CATEGORY => NULL

,P_PROGRAM_LOGIN_ID => NULL

,P_ACCOUNT_ID => NULL

,P_TAX_CLASSIFICATION_CODE => NULL

,P_ATTRIBUTE7 => NULL

,P_ATTRIBUTE8 => NULL

,P_ATTRIBUTE9 => NULL

,P_ATTRIBUTE10 => NULL

,P_ATTRIBUTE11 => NULL

,P_ATTRIBUTE12 => NULL

,P_ATTRIBUTE13 => NULL

,X_RETURN_STATUS => X_RETURN_STATUS

);

DBMS_OUTPUT.PUT_LINE('RETURN STATUS :' X_RETURN_STATUS);

COMMIT;

END;

--EXCLUDE FREIGHT FROM DISCOUNT--

SELECT APS.VENDOR_NAME,APS.EXCLUDE_FREIGHT_FROM_DISCOUNT VEND_EXCD,

APSS.VENDOR_SITE_CODE,

APSS.EXCLUDE_FREIGHT_FROM_DISCOUNT SITE_EXCD

FROM APPS.AP_SUPPLIERS APS,

APPS.AP_SUPPLIER_SITES_ALL APSS

WHERE APS.VENDOR_ID = APSS.VENDOR_ID

AND APS.VENDOR_ID NOT IN (1, 2, 3)

AND APSS.EXCLUDE_FREIGHT_FROM_DISCOUNT IS NULL

AND APS.EXCLUDE_FREIGHT_FROM_DISCOUNT IS NULL

Oracle Certification Program Fraudulent Activity Policy

Oracle reserves the right to take action against any candidate involved in fraudulent activities, including, but not limited to, fraudulent use of vouchers, promotional codes, reselling exam discounts and vouchers, cheating on an exam, alteration of score reports, alteration of completion certificates, violation of exam retake policies or other activities deemed fraudulent by Oracle.

If Oracle determines, in its sole discretion, that fraudulent activity has taken place, it reserves the right to take action up to and including, but not limited to, decertification of a candidate's Oracle Certified Associate, Oracle Certified Professional and/or OCM credentials, temporary, indefinite or permanent ban of a candidate from Oracle certification programs, notification to a candidate's employer, and notification to law enforcement agencies. Candidates found committing fraudulent activities forfeit all fees previously paid to Oracle, or to Oracle's authorized vendors, and may be required to pay additional fees for services rendered.

View the Oracle Certification Program Candidate Agreement, which requires your agreement before the start of each exam.